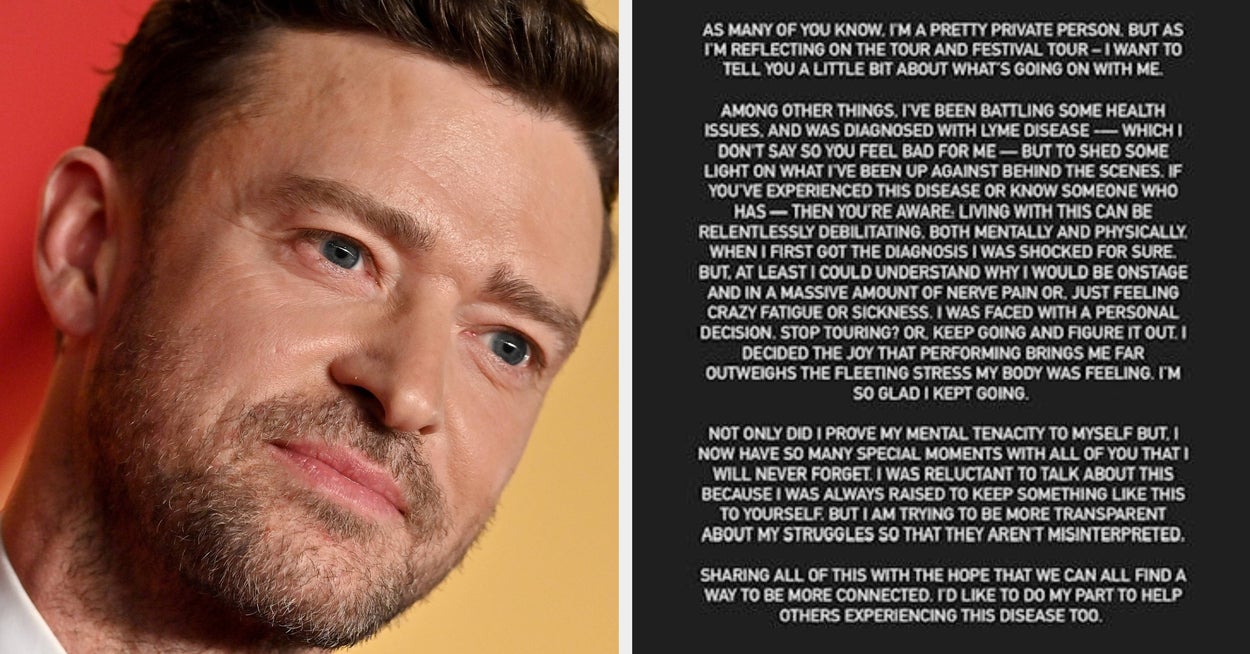

After Viral Videos Of Justin Timberlake Hardly Singing Went Viral, He Revealed A "Debilitating" Health Diagnosis

Source: https://www.buzzfeed.com/chelseastewart/justin-timberlake-has-lyme-disease

How to Apply for Health Insurance in USA Step by Step

Step 1: Assess Your Needs

Consider your medical history, family needs, and budget. Ask yourself: Do I need frequent doctor visits? Do I take medications regularly? Your answers will help determine the best plan for you.

Step 7: Check Subsidy Eligibility

You may qualify for tax credits, Medicaid, or CHIP. These reduce your costs significantly. Submit your financial info accurately.

Step 8: Confirm & Pay

Submit your application and make the first payment to activate your coverage. You’ll receive an insurance card shortly after.

Conclusion

Applying for health insurance doesn’t have to be overwhelming. By following these steps, you ensure your health and finances are protected.

Step 5: Apply for Coverage

Use HealthCare.gov, state exchanges, brokers, or even phone/mail to apply. Choose a convenient channel.

Step 4: Understand Enrollment Periods

Open enrollment happens once a year. Special enrollment is triggered by life events like job loss or birth. Apply during valid periods to avoid penalties.

Introduction

Health insurance in the United States is a critical investment for anyone seeking financial protection from the high costs of healthcare. This step-by-step guide walks you through the process of applying for health insurance in the USA.

Step 6: Compare Plan Benefits

Compare premiums, deductibles, co-pays, networks, and drug coverage. Use comparison tools to make the best decision.

Step 3: Gather Required Documents

You’ll typically need your name, SSN, income proof, and other details like employer or household information to apply.

Glossary

- Premium: Monthly cost of the plan

- Deductible: What you pay before insurance pays

- Copay: Flat fee for services

- Coinsurance: Shared cost after deductible

- OOP Max: Maximum yearly out-of-pocket

Step 9: Use Your Plan Wisely

Schedule regular checkups, stay in-network, and review your plan’s benefits to avoid surprise bills.

Step 2: Understand Types of Plans

There are various types of health plans: Employer-sponsored, ACA marketplace plans, Medicare, Medicaid, and private plans. Know which category you fall into to explore your options.

Comments

Post a Comment